dallas texas local sales tax rate

The Texas state sales tax rate is currently. The current total local sales tax rate in Dallas TX is 8250The December 2018 total local sales tax rate was also 8250.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community.

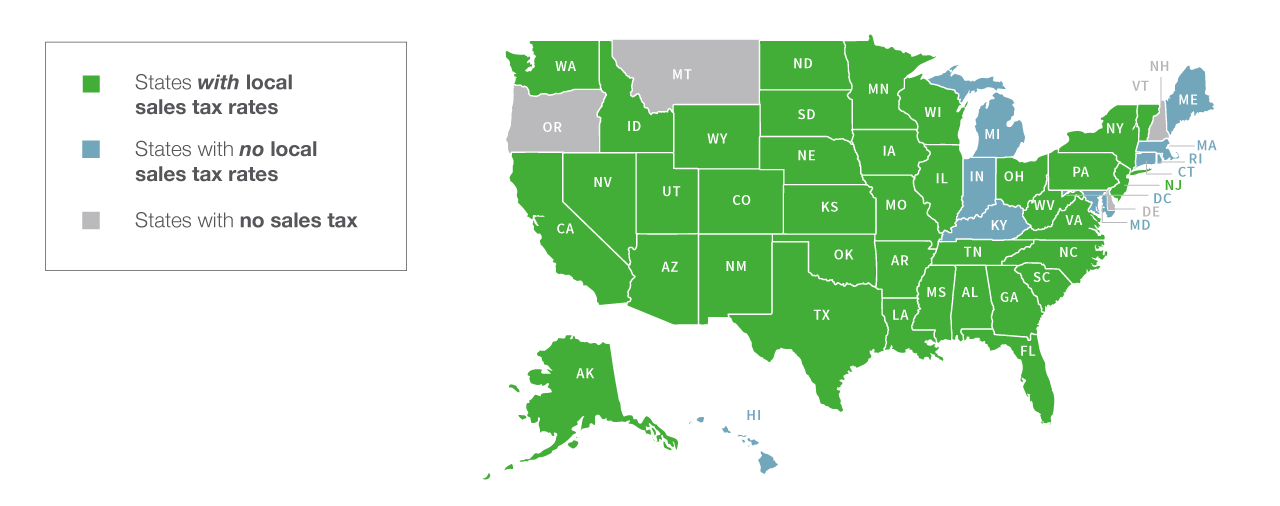

. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. The 825 sales tax rate in. Create your own online store and start selling today.

This is the total of state county and city sales tax rates. 214 653-7811 Fax. Terminate or Reinstate a Business.

The 2018 United States Supreme Court decision in South Dakota v. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. Sales Tax Rate Locator.

The local sales tax rate in dallas county is 0 and the maximum rate including texas and city sales taxes is 825 as of november 2021. Sales Tax Permit Application. Houston Dallas San Antonio Austin and El Paso all have local taxes that bring the total sales tax up to the 825 maximum.

If an exact rate is not returned click on HELP above right corner for more information. The Dallas Texas sales tax is 625 the same as the Texas state sales tax. The current total local sales tax rate in Dallas TX is 8250.

City sales and use tax codes and rates. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and. 2022 Tax Rates Estimated 2021 Tax Rates.

33 rows Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum. TEXAS SALES AND USE TAX RATES April 2022. The current total local sales tax rate in Dallas TX is 8250.

The County sales tax rate is. The Dallas County sales tax rate is. Dallas in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Dallas totaling 2.

The Dallas sales tax rate is. Taxes Home Texas Taxes. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. The December 2017 total local sales tax rate was also 8250. Denton TX Sales Tax Rate.

You can find more tax rates and allowances for Dallas and Texas in the 2022 Texas Tax Tables. The minimum combined 2022 sales tax rate for Dallas Texas is. The December 2017 total local sales tax rate was also 8250.

Dallas Co 2057217 010000 082500 Allentown 067500. Three cities follow with combined rates of 10 percent or higher. The Texas sales tax rate is currently.

About 39 percent of total revenue of local governments in Texas. Dallas TX is in Dallas County. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas.

The current total local sales tax rate in dallas tx is 8250. Approves Local-Option Sales Tax A vote must pass on the March ballot for tax collections to begin July 1 which is when Dallas Countys one-cent tax goes into effect. The extra tax is limited to 2 making the maximum rate statewide 825.

The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825. If you are buying a car for 2500000. The minimum combined 2022 sales tax rate for Dallas County Texas is.

Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate AmherstLamb Co 2140010 012500 075000 ArcherCity 2005023 015000 082500. This variation reflects the different. Has impacted many state nexus laws and sales tax collection requirements.

Dallas TX Sales Tax Rate. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. Texas Comptroller of Public Accounts.

Sales tax rate depending on where they purchase a taxable item. State Income Tax Refunds OnLine Taxes provides you with the status of your federal income tax refund and state income tax refund. The dallas sales tax rate is.

TEXAS SALES AND USE TAX RATES April 2022. Property taxes represented about 80 percent of total local government tax revenue while sales taxes represented about 17 percent2 Local Taxes. Enter the Address City and Zip Code in the above fields to obtain the tax jurisdiction s and tax rate s for the address entered.

This is the total of state and county sales tax rates. Local Code Local. 4 rows Dallas collects the maximum legal local sales tax.

You may also call 1-800-829-4477 to check on the status of.

Weekly Allmanac For 4 3 14 Dallas Dallasrealestate Realestatemarket Real Estate Marketing Dallas Real Estate Dallas

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Guide And Calculator 2022 Taxjar

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

How To File And Pay Sales Tax In Texas Taxvalet

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Guide For Businesses

Texas Sales Tax Rates By City County 2022

Sales Tax On Grocery Items Taxjar

Texas Sales Tax Small Business Guide Truic

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax