non filing of tax return meaning

There are some myths associated with filing. Today my transcripts updated to show the following under Return Transcript for 2020.

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Examination uses this procedure to establish an account and examine the records of a taxpayer when the taxpayer refuses or is unable to file and information received indicates.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

. An Income tax return ITR is a form used to file information about your income and tax to the Income Tax Department. However the benefits lost on non-filing of returns are more than the penal provisions imposed for non-filing. PENALTIES FOR LATE FILING OF TAX RETURNS.

Whether the non-compliance is a mere omission. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7. The tax liability of a taxpayer is calculated based on his.

Follow prompts to enter the. Select Option 1 for English. Based On Circumstances You May Already Qualify For Tax Relief.

We have no record of a filed Form 1040 1040A or. Comparing the advantages and disadvantages of being tax filer and non-filer source in FBR said that immediately after filing income tax returns the name of the filer would be enlisted among. Non-filing of Income Tax Return by itself would not mean that the complainant had no source of income and thus no adverse inference can be drawn in this regard only.

The specifics regarding imprisonment are as follows. Free Case Review Begin Online. If requested on your FAST page please obtain a Verification of Non-Filing letter from the IRS and submit a copy to the Financial Aid Office.

The Tax Code considers failure to file ITR and failure to pay income tax as crimes of the same nature and gravity because these two crimes are found in the same Section 255 of. As of the date of. The non-filing and the non-payment of tax returns are two of the most common violations committed by the taxpaying public.

Ad See If You Qualify For IRS Fresh Start Program. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due. FDAP income is taxed at a flat 30 percent or lower.

For possible tax evasion exceeding Rs25 lakhs. Effectively Connected Income should be reported on page one of Form 1040-NR US. A student or parent who has never.

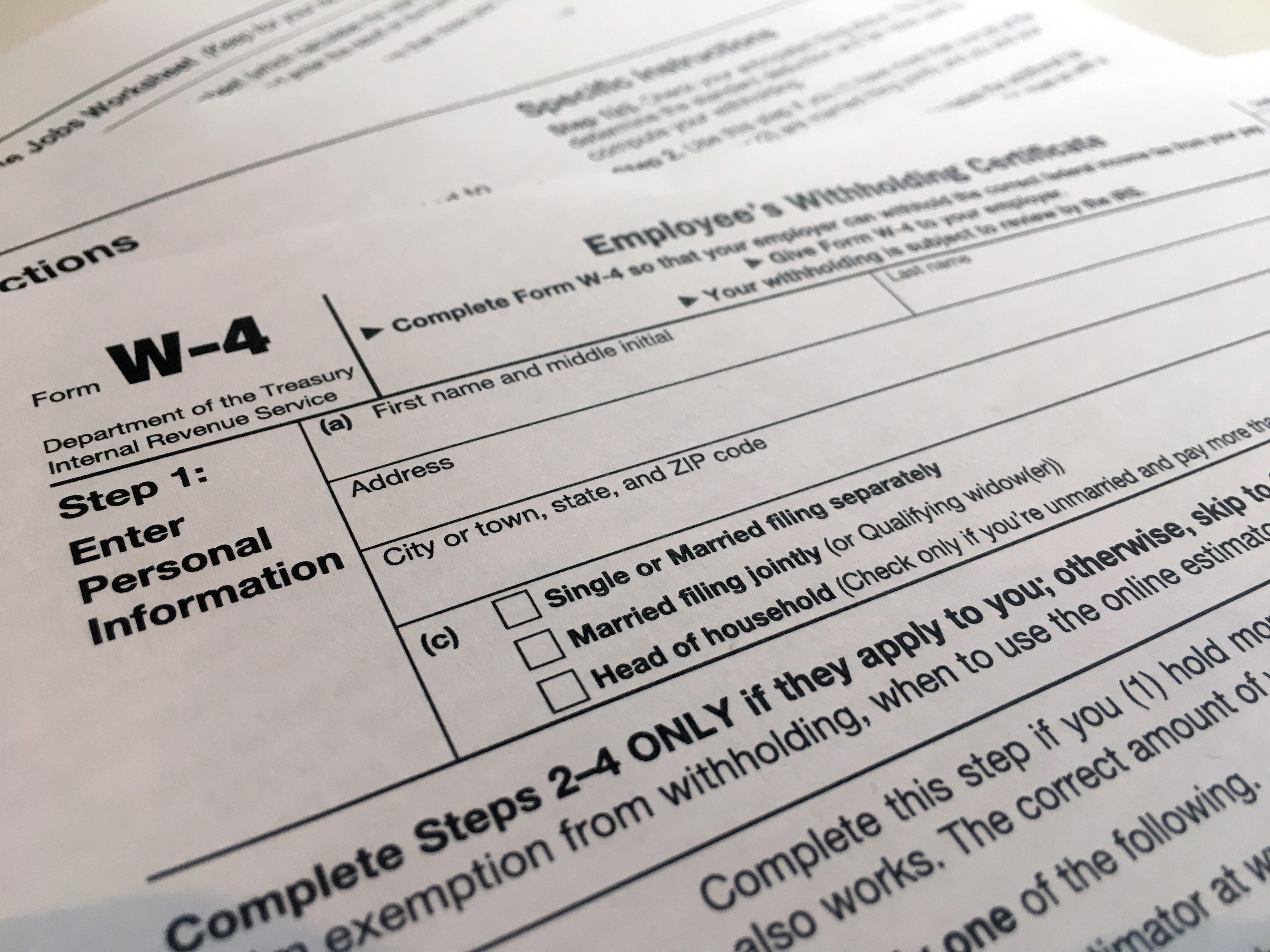

Following are the benefits of filing of the income tax returns. In some cases the student will receive IRS Form 13873 from the IRS instead of a Verification of Non-filing Letter. Tax filers must follow prompts to enter their social security number.

Nonresident Alien Income Tax Return. It says We received a request dated March 30 2020 for verification of non-filing of returns for the above tax period or periods. Available from the IRS by calling 1-800-908-9946.

On June 18 2021 we received a request for verification of non-filing of a tax return.

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

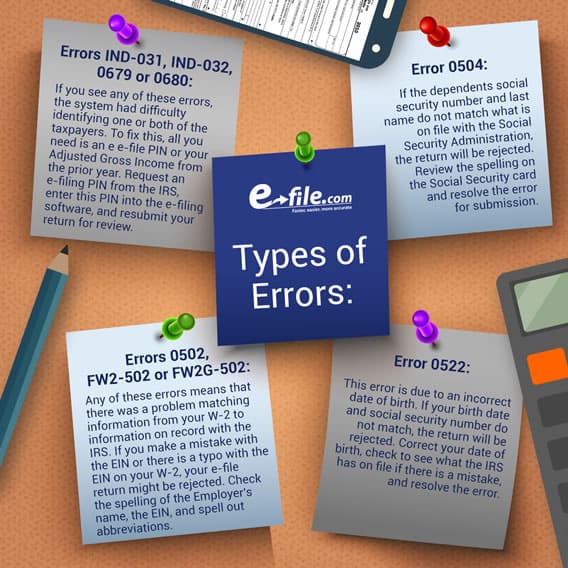

Possible Rejection Reasons When E Filing Taxes E File Com

Penalties For Filing Your Tax Return Late Kiplinger

Top 8 Irs Tax Forms Everything You Need To Know Taxact

Irs Letter 4903 No Record Of Receiving Your Tax Return H R Block

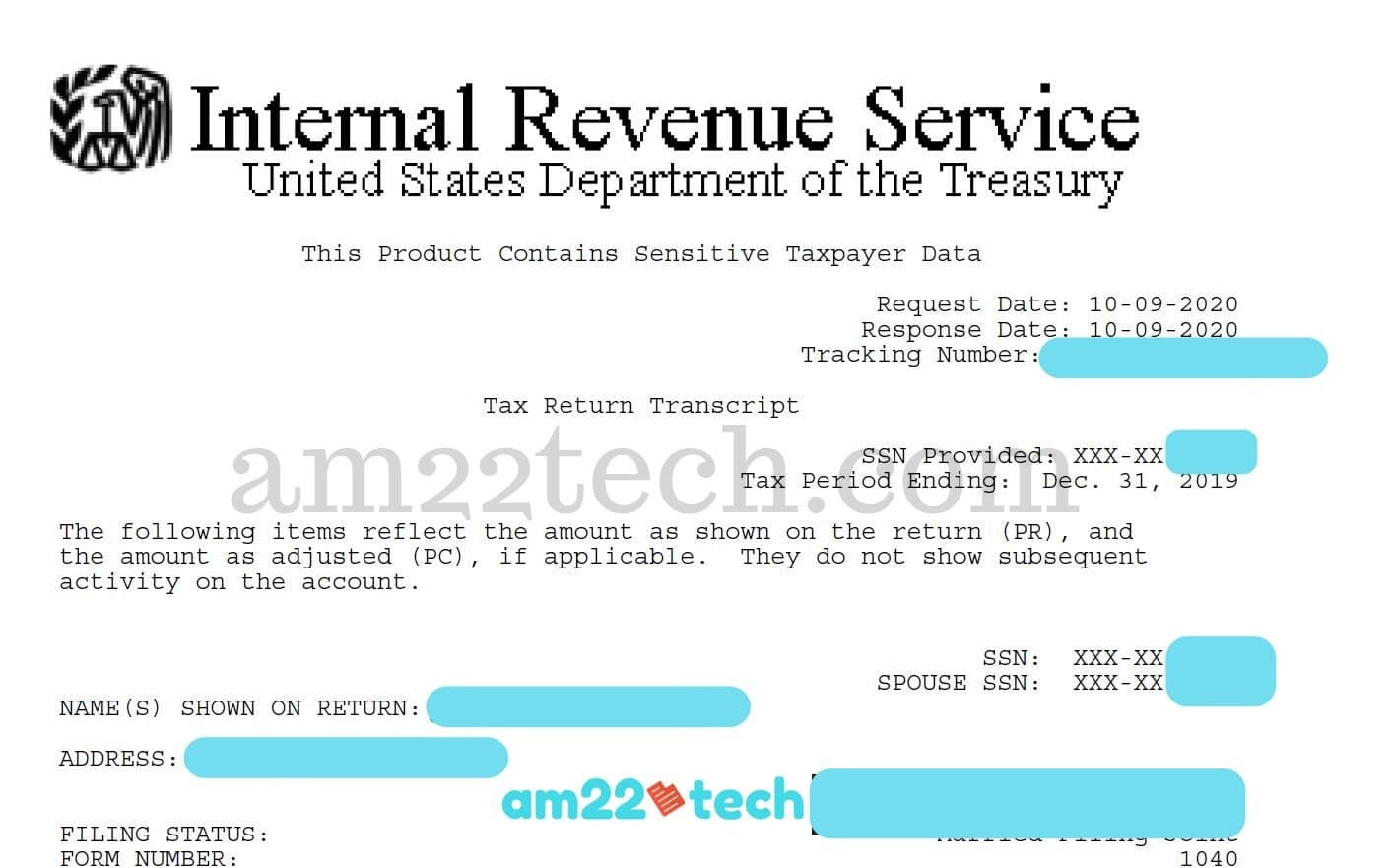

How To Get Irs Tax Transcript Online For I 485 Filing Usa

What To Do If You Receive A Missing Tax Return Notice From The Irs

Free File Can Help People Who Have No Filing Requirement Find Overlooked Tax Credits Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

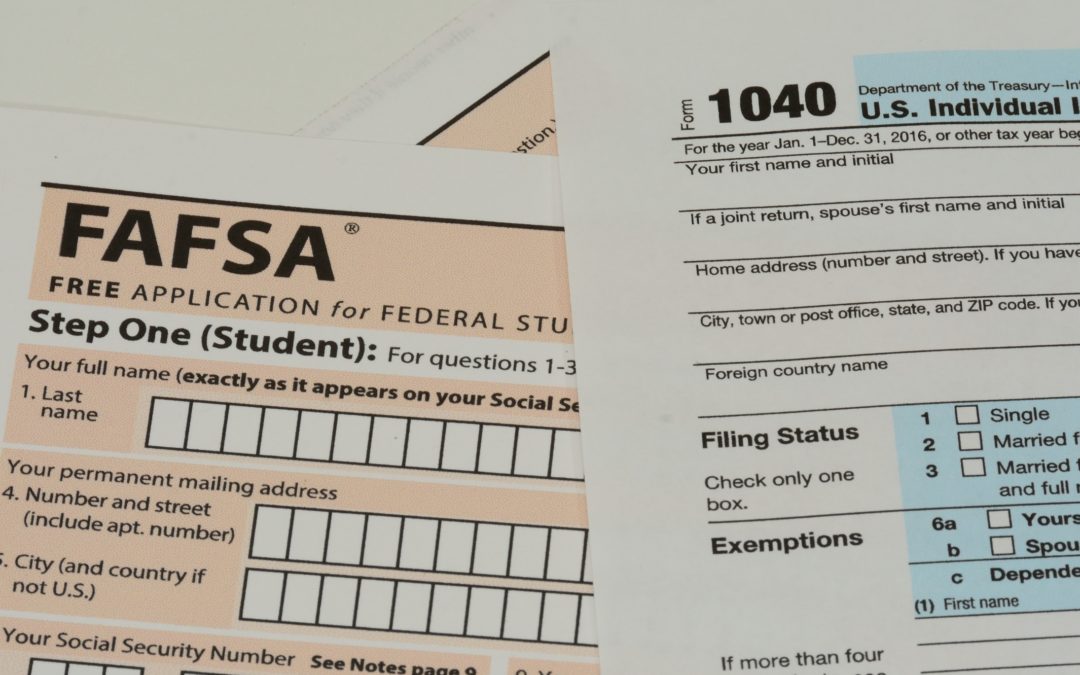

How To Fill Out A Fafsa Without A Tax Return H R Block

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

What To Do If You Receive A Missing Tax Return Notice From The Irs

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)